Exploring the Financial Impact of Electric Vehicles

As financial professionals, we’ve noticed a trend among our clients: an increasing interest in electric vehicles (EVs). To help address some of your questions, we’ve compiled this high-level guide to provide insights into the financial aspects of owning an electric car, including the pros and cons as well as cost considerations.

While the industry has some EV enthusiasts, there are also skeptics. In 2022, according to Cox Automotive, EVs made up only 5.9% of new vehicle sales in the U.S. That grew to 7.6% in 2023, indicating an increasing demand for EV transportation solutions.1

So, what are some of the financial pros and cons?

Purchase Price

EVs tend to be more expensive than gas vehicles with similar features. According to data from Kelley Blue Book, the average transaction price for electric cars was $56,371 in June 2024 vs. $48,644 for gas-powered vehicles.2

In part, the differential in price might be narrowed by incentives when buying new or used EVs. In 2024, the federal government is offering qualified buyers up to $7,500 to purchase select fully electric, plug-in hybrid, and fuel-cell vehicles. (Leases may also qualify for the $7,500 credit.) Used electric cars may qualify for up to $4,000 on specific models.2

To be eligible, you must purchase the vehicle for your own use, not for resale, and primarily use it in the U.S. Additionally, your modified adjusted gross income (AGI) must not exceed certain thresholds: $300,000 for married couples filing jointly or for a surviving spouse, $225,000 for heads of households, and $150,000 for all other filers. You can use your modified AGI from either the year you take delivery of the vehicle or the year before, whichever is less.

Pro Tip: If you are price shopping for an EV, the federal tax incentives may have already been factored into the advertised lease payments.1

Keep in mind that this blog post is for informational purposes only and is not a replacement for real-life advice. Consult your tax, legal, and accounting professionals if the tax incentives are a key consideration as you evaluate EVs. Also, tax incentives can change without notice, and there is no guarantee that the current incentive will remain in place.

Maintenance Costs

EVs can require less maintenance than gas-powered combustion-engine vehicles. In a gas vehicle, manufacturers suggest that engine oil be changed regularly, and they have guidelines for other fluids. EVs, on the other hand, have fewer fluids, which can lead to less periodic upkeep. In addition, EVs have less brake wear due to regenerative braking.3

Both gas-powered cars and EVs are machines, so an owner’s experience will be unique to their situation. However, from the highest level, EVs have fewer moving parts than cars with a combustion engine.3

Fueling Costs

One benefit of EVs is that they can be cheaper to drive. The average EV costs about 3–5 cents per mile at the 15 cent/kWh national average. A gas-powered vehicle that gets around 25 miles per gallon costs around 15 cents per mile at a price of $3.50 per gallon. When all the math is calculated, it costs 3 to 4 times more to drive a gas-powered car than it does to drive an electric vehicle.4

However, despite the cost, fueling a gas-powered car is more convenient than charging an EV. The U.S. averages about 104 gas pumps per 1,000 road miles, compared to just 22 EV charging ports. It also takes more time to charge an EV than to pump gas into a car.5

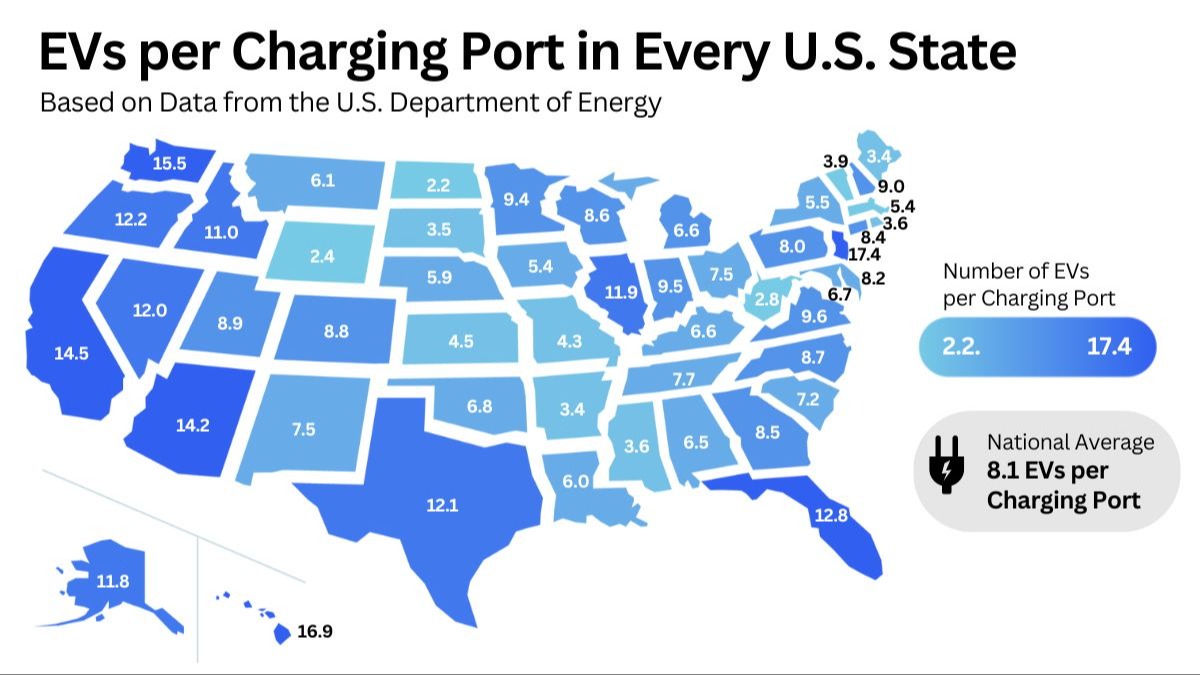

Finding an open EV charging port may be challenging, depending on where you live and drive. The chart below shows the number of registered EVs by state versus the number of public charging ports. The higher the value, the more difficulty an EV driver may have charging their car. For example, in Illinois, there are almost 12 EVs per charging port, meaning drivers may have longer wait times when charging their vehicles.5

The number of public charging stations in the U.S. is growing. In 2023, there were 64,187 EV charging stations across the country. That’s an increase of 20% over 2022, when there were 53,492 stations. The growth of charging station infrastructure across the U.S. increased at a 43.7% compound annual growth rate from 2018 to 2023.6

Charging Costs7

Installing a home charging station for your electric vehicle is also a consideration in the overall cost of EV ownership. There are different levels of chargers, each with varying costs and installation requirements. Level 1 chargers, often included with an EV purchase, use a standard 120-volt household outlet and can charge an EV battery to 80% in about 40–50 hours.

The equipment for Level 1 chargers typically costs between $300 and $600 in addition to installation costs, especially in older homes that may require electrical upgrades.

Level 2 chargers, which require a 240-volt circuit, can charge an EV to 80% in 4 to 10 hours. These chargers usually need to be purchased separately, with equipment costs ranging from $500 to $700. Installation can be more complex and costly, often necessitating electrical system upgrades.

Level 3 chargers are typically found in public charging stations and are not commonly used for residential purposes due to their high cost. The equipment alone can cost tens of thousands of dollars, not including installation costs.

Beyond the initial setup, other costs can include charging pedestals, outdoor charger weatherproofing, trenching for detached garages, and multiple adapters for different EV brands. And while charging an EV at home may increase your electricity use, some EVs can act as generators to power your home during blackouts. It’s also worth noting that some automakers offer installation credits with the purchase of an EV, and government programs may offset some of these costs through incentives.

However, much like tax incentives when purchasing a new or used EV, charging station incentives can change without notice, and there is no guarantee that automaker or government programs will remain in place.

EV Impact on Auto Insurance Premiums:

Policy prices depend on a wide range of factors, including the specific model and your circumstances. Before moving forward, consult your insurance professional, who may be able to provide insights into various policy choices.

Conclusion

As financial professionals, we recognize that while EVs offer potential savings in fuel and maintenance costs, it’s crucial to weigh these benefits against the initial higher purchase price and other factors. We encourage our clients to consider their financial situations, driving habits, and long-term goals when deciding whether to purchase an electric vehicle. As always, we’re here to help you navigate these decisions and integrate them into your overall financial strategy.

1 U.S. News & World Report, May 1, 2024,

2 Kelley Blue Book, July 15, 2024,

3 U.S. News & World Report, October 25, 2023

4 EVLife.com, April 3, 2024

5 Motor.com, August 9, 2023

6 ConsumerAffairs.com, February 20, 2024

7 Capitalone.com, October 31, 2023